Welcome to Unqualified Opinion

We offer blog articles, books, digital tools, courses, community & advice

Whether you need help with Finance, Neurodivergence, Menopause, Toxic Relationships, Chronic Illness, Gut Health, Nutrition, Personal Growth, or Spirituality...

We aim to empower you to live a happier, healthier, safer and more confident life!

New & Featured Posts

(Our articles are 100% original material, never AI Generated)

Running a business is hard enough when you’re healthy. When you’re managing chronic illness on top of it, the challenge can feel twice as heavy. You’re not only juggling clients, deadlines, and invoices, but also flare days, fatigue, brain fog, or mobility struggles. That’s where affirmations come in — not the fluffy kind plastered over pastel Instagram posts, but real, grounded mantras that remind you of your worth, your capability, and your right to build a business that works with your body, not against it. Let’s walk through affirmations designed specifically for the chronically ill entrepreneur, and explore how to live them out in daily life. 1. “My business can succeed at the speed of my body.” When you’re chronically ill, productivity doesn’t always look like a nine-to-five grind. Some days are half-hour bursts followed by rest. Some days are a gentle laptop session in bed. And some days, it’s no work at all. This doesn’t make you less of an entrepreneur. It makes you a strategist. You’re learning to work in alignment with your energy. When your body slows you down, it’s not sabotage — it’s wisdom. Try this: Build “flex weeks” into your schedule. Structure client projects with buffer space so flare-ups don’t derail everything. Use scheduling tools to post content in advance, so your visibility continues even while you rest. 2. “Rest is not wasted time, it is strategy.” Chronic illness teaches you something most entrepreneurs only learn the hard way: without rest, there is no sustainability. Rest is not the absence of progress. It is the foundation of progress. When you rest, your nervous system recalibrates. Your creativity gets room to breathe. Your body regains enough energy to take the next step. Think of it as fuel. You wouldn’t expect a car to run without stopping for gas. Try this: Create a rest menu. List activities that actually restore you: naps, quiet time, herbal tea, audiobooks, weighted blankets. Use the menu instead of pushing through exhaustion. 3. “I create in ways that honour my limits, not punish them.” Traditional entrepreneurship loves the “hustle harder” mentality. Chronic illness forces a different question: how can I create in a way that works with my body today? Maybe you record short voice notes instead of writing long drafts. Maybe you film videos on high-energy days and schedule them out. Maybe you switch from three-hour deep work blocks to 20-minute sprints. These adaptations are not weaknesses. They are proof of your resilience. Try this: Audit your current workflow. Which tasks drain you most? Which can be simplified, delegated, or automated? Every adaptation is a way of respecting your energy. 4. “I am allowed to grow my business slowly.” The world will tell you growth has to be fast. Scale quickly, push harder, chase the next big thing. But when you live with chronic illness, slow growth is not failure. It’s intentional. It’s sustainable. A slower pace doesn’t mean you’re falling behind. It means you’re building something that lasts. You don’t need viral numbers or overnight success. You need a business model that supports you for years to come. Try this: Focus on consistency over intensity. One blog post a month. One client project at a time. Small steps done steadily add up to momentum. 5. “I am more than my most productive day.” Chronic illness can make you feel like your worth is tied to what you get done. On flare days, that voice whispers: you’re falling behind, you’re not doing enough. But your value doesn’t vanish when you rest. Your brilliance doesn’t disappear when you can’t check a box. You are still the same creative, capable entrepreneur on a slow day as you are on your best day. Try this: Keep a “wins list.” Write down client testimonials, completed projects, kind messages, moments of impact. On hard days, revisit it to remind yourself that progress isn’t erased by one day of rest. 6. “I choose systems that support me, not drain me.” Living with chronic illness means you have to be ruthless about conserving energy. That applies to your business systems too. Clunky tech, chaotic workflows, or outdated tools drain you faster than any flare-up. The fix isn’t working harder, it’s working smarter. Automate invoices. Use templates. Batch tasks. Create canned email responses. Every system you simplify is one less energy leak. Try this: Write down your three most repetitive business tasks. Then ask, “How can I automate or outsource this?” 7. “I can delegate without guilt.” You don’t have to do everything alone. Chronic illness often forces entrepreneurs to face the reality that outsourcing isn’t a luxury, it’s survival. Whether it’s hiring a virtual assistant for admin, a designer for branding, or a meal service for daily life, delegation is not laziness. It’s leadership. Try this: Start small. Hire someone for five hours a month. See what it feels like to let go of one task. Notice the space it creates for both your business and your health. 8. “I am resilient in ways most people can’t see.” Chronic illness requires a quiet kind of strength. The kind where you still show up after nights of pain. The kind where you write, coach, or create through brain fog. The kind where you manage client calls while monitoring your body’s limits. That resilience may not be visible to the outside world, but it shapes every part of your entrepreneurial journey. It’s proof that you can adapt, adjust, and rise in ways most people will never understand. Try this: Write down five ways your chronic illness has made you a stronger entrepreneur. Keep it somewhere visible as proof of your resilience. 9. “My pace is still progress.” Entrepreneurship is not a race, it’s a journey. When you live with chronic illness, your pace might look different, but it’s still movement forward. Progress is progress, whether it takes weeks, months, or years. Celebrate the fact that you’re still building, even while managing fatigue, pain, or unpredictable days. That is not small. That is extraordinary. Try this: Replace the phrase “I’m behind” with “I’m moving forward.” Notice how your nervous system relaxes when you shift the language. 10. “I am allowed to design success on my terms.” Success doesn’t have to look like long hours, massive launches, or constant visibility. For chronically ill entrepreneurs, success might mean steady clients, financial stability, flexibility to rest, or the ability to keep creating without burnout. You get to decide what success means. Not society. Not hustle culture. Not anyone else. Try this: Write your own definition of success. Keep it in front of you as a reminder that your business is allowed to reflect your body’s needs. Living the Affirmations Affirmations are not magic spells. They don’t erase fatigue, pain, or unpredictable symptoms. But they reframe how you approach business when illness complicates the path. They’re reminders that you are capable, resourceful, and allowed to build a business at a pace and style that works for you. Use them daily. Whisper them when self-doubt creeps in. Write them on sticky notes. Record them in your phone and play them on low-energy days. Let them anchor you when your body feels unpredictable but your vision remains steady. Entrepreneurship with chronic illness is not easy. It demands creativity, adaptability, and patience. But you are proof that great things can be built slowly, steadily, and with compassion for your body. Your business does not need to follow the traditional path. Your body is not an obstacle to success — it is the guide that shows you how to create something sustainable. So the next time the world tells you to hustle harder, remember these affirmations. You are still moving forward. You are still creating. And you are still enough, right here, right now.

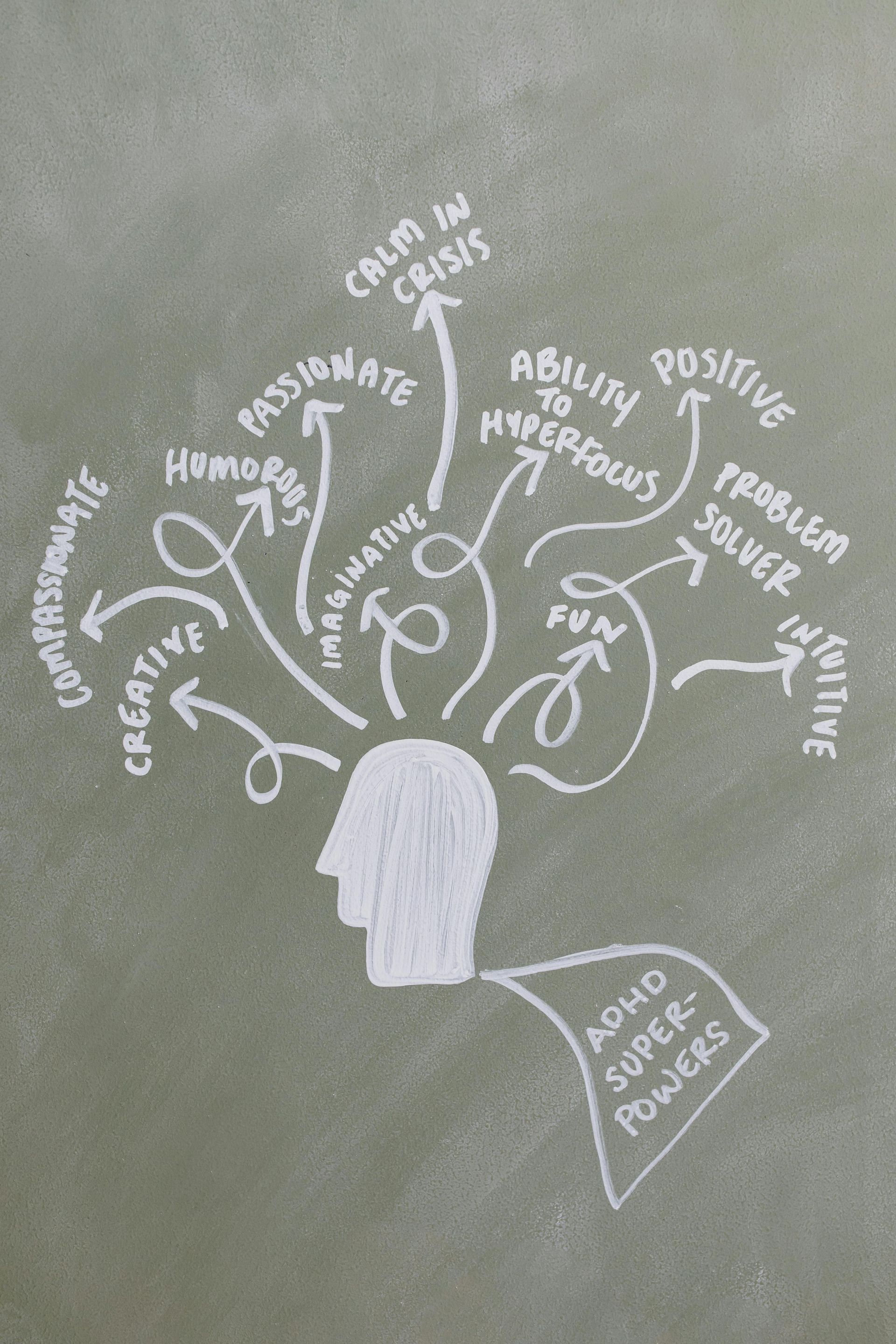

I have said it before, and I will say it again and again: It's not that neurodivergent folks are “bad with money” — it's that we are expected to navigate a financial system that doesn't jive with how our brains actually work. But that doesn’t mean we can’t totally slay our money goals — it just means we need a system that speaks fluent dopamine, not shame spirals. This mini-guide is your step-by-step walkthrough to building a budget that’s actually sustainable, even if executive function is a daily gamble and impulse control depends on how overstimulated you are. Step 1: Learn the Basics (AKA: WTF is a Budget?) Before we build a system that works for your brain, let’s decode the basics — but don’t worry, we’re skipping the jargon. A budget is just a plan for where your money goes. That’s it. It’s not a moral test. It’s not a grade on your life. It’s a tool. Think of it as your money GPS — it helps you get where you want to go financially, without driving in circles until you run out of gas (or rent money). Here’s what you need to know: Track what’s coming in (hello, income). Track what’s going out (rent, snacks, subscriptions you forgot you had). Figure out your financial goals (freedom? travel? paying off soul-sucking debt?). Separate needs from wants — but make sure dopamine gets a seat at the table too. Wants aren’t evil. They’re fuel. Once you’ve got that down, you’re ready for the fun part: turning this into something that feels good to maintain. Step 2: Name Your Expenses (a.k.a. Budget Like a Detective) Time to get nosy with your money. Grab your bank statements, your brain, and maybe a snack — this is your budgeting stakeout. Start with: Fixed expenses: Rent, insurance, internet — these don’t change much. Variable expenses: Groceries, gas, that one “emergency” Target run that somehow cost $200. Sneaky dopamine leaks: Little purchases that hit your brain's reward center but leave your budget gasping. (Looking at you, impulse DoorDash.) Now — prioritize. And no, that doesn’t mean cutting out every fun thing. It means making sure your must-haves are covered before your brain convinces you to emotionally invest in an air fryer, ten candles, and a laser keyboard. Hot Tip: Rank your expenses using three buckets: Non-negotiable survival stuff Growth + freedom investments Dopamine treats that are worth it (on purpose) You’re not depriving yourself — you’re taking the wheel. Step 3: Build Your Budget, Not Suze Orman’s Here’s where it gets personal. Neurodivergent brains need systems that are flexible, visual, forgiving, and (ideally) kind of fun. That means your budget should work with your brain, not against it. Ask yourself: Do you need visuals? (Color-coded charts, sticker rewards, tracked progress?) Do you need sensory reminders? (Journaling with gel pens? A cozy blanket budget session?) Do you need simplicity? (Like, two categories: “Money I Can Use” and “Money I Can’t Touch”?) Do you need automation because time blindness is real? (Auto-pay and savings transfers = chef’s kiss.) There’s no “right” way — there’s only what actually helps you show up consistently. Pick a method: Incremental budgeting: build slowly, focus on progress over perfection. Zero-based budget: Every dollar has a job, super strict! Envelope systems or apps: great for tactile or visual learners. 50/30/20 rules: structured but adjustable. The Dopamine Budget™ Method (hi, it’s us): reward-based, priority-driven, and guilt-free. The key: make it yours. Neurodivergent brains thrive when we’re given permission to innovate. So give yourself that permission. Step 4: Lock In the Long Game (Even If Your Brain Lives in the Now) Okay, you’ve got your budget bones — now let’s give it some staying power. Neurodivergent budgeting isn’t about bootstraps or spreadsheets. It’s about systems that reduce friction and spark motivation. Here’s how to future-proof your finances: Set dopamine-aligned goals Don’t just save for “retirement” — yawn. Save for things that light you up. A trip? A gaming console? Financial peace? Put it front and center. Track your progress — in a fun way Think sticker charts, color-coded graphs, or a “money wins” jar. Celebrate every step. Automate what you can We love a good routine because we forget things. Automate savings, bills, and transfers so you don’t have to remember (or panic at 2 a.m.). Check in regularly — without judgment Treat it like a vibe check, not a performance review. “What’s working? What’s not? What do I need this month?” Find your support system That could be a money coach, a therapist who gets executive dysfunction, or even a friend who’ll cheer you on after paying off your phone bill. Budgeting Isn’t a Personality Test — It’s a Power Move By understanding the basics, getting honest with your expenses, creating a plan that’s actually human hello sensory needs), and committing to strategies that spark consistency — you’re not just managing money. You’re taking back control of your narrative. Budgeting doesn’t have to be boring, rigid, or shaming. It can be dopamine-fueled, rebellious, and low-key delightful. So ditch the guilt. Set the goal. Make it yours. Need more help? In August 2025, I am launching: Financially Fluent AF™: Money Truths That’ll Save Your Sanity This self-paced, no-BS neurodivergent-friendly, no-shame-needed-course, breaks down 20 foundational money truths in a way that’s finally clear, empowering, and actually fun. We skip the jargon and go straight for the glow-up. Course includes life-time access to all modules, digital downloads, quizzes, and trackers. Sign up for free to Unqualified Opinion here and be the first to know when doors open!!

Alata

Alice

Open Sans

Noto Sans

Bebas Neue

Great Vibes

Rock Salt

Exo

Belgrano

Overlock

Cinzel

Indie Flower

Staatliches

Roboto Slab

Lato

Noto Serif

Open Sans

Montserrat

Ubuntu

Rubik

Delius

Amiri

Montserrat